May 10, 2021 – Renewable energy certificates (RECs) represent the environmental attributes of renewable generation and are measured and sold per Megawatt-Hour (MWh) of energy produced. Voluntary RECs are those purchased beyond statutory obligation and are often certified under the nationally recognized Green-e program administered by the Center for Resource Solutions.

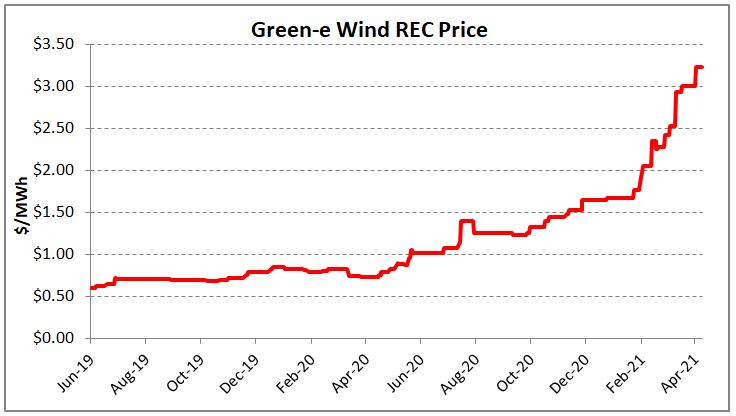

Over the past 24 months, voluntary REC prices have increased nearly fivefold as supply has tightened and corporate buying has grown significantly. Since mid-2019, the price of voluntary RECs created by wind generation has increased from under $0.70/MWh to just over $3.00/MWh. Signs of decreased REC production from new projects, looming expiration of Green-e certifications for existing generators, and accelerated corporate buying to meet ESG and carbon reduction goals all point to continued increases in price over the next 3-5 years.

Large-Scale and Long-Term Buying

Major corporations such as GM, who announced an agreement to purchase all of the RECs from a 180 Megawatt (MW) solar farm in Arkansas in late 2020, and PepsiCo, who announced 650 MW of wind agreements in Texas in early 2021, have soaked up a lot of current, and future supply. There are growing Renewable Portfolio Standard (RPS) requirements in several states, which could provide developers access to more lucrative statutory markets for their RECs. Further, many states are soliciting directly with wind developers to construct large-scale projects to meet state climate goals. Offerings include 20+ year contracts for their energy and associated RECs, buying those RECs at prices much higher than voluntary markets would have provided.

Those long-term commitments and contracts are doing an incredible job of driving the buildout of renewable generation in the US; however, the increasing demand for RECs continues to outpace the speed at which new

REC production facilities can be constructed. Further, certification periods for existing generators are beginning to expire, meaning those facilities will need to re-invest and remodel to continue to be sold as certified green resources, or the RECs they create now will stop being available to voluntary buyers.

Slowing Development

We could also see a decline in expected output per project as the most financially viable sites are built out, leaving only less attractive and more costly sites available for development. The attributes that can make a site more economically feasible to develop can include:

- steady wind to ensure good production,

- proximity to demand centers or existing transmission infrastructure,

- local geography, which can influence construction costs, and

- distance to population, which can impact public resistance.

Offshore wind developments hold incredible potential for generation output but are significantly more expensive than onshore to construct and maintain. Some estimates on the differential between onshore and offshore wind put the construction cost at nearly double and the maintenance at roughly 50% higher. Some of those additional costs are countered by more consistent wind patterns offshore, improving turbine output to almost 40% in most cases, while onshore can typically see half that.

Using European wind development, which is far more advanced than the US, as an example, we can see that to justify the build of second or third-tier sites, an implied REC funding of $8-16/MWh is required for offshore, while onshore requires only $6-14/MWh.

What drives these cost increases is pretty straightforward, but what the future likely holds requires a bit more explanation.

Potential Future Price Trends

With sustainability and carbon footprint reductions a key driver of demand for voluntary renewable products such as Green-e RECs, taking a closer look at carbon intensity in the US is a good start towards understanding future pricing dynamics.

According to the most recent data from the US EPA based on the national energy mix for electric generation in the US, one MWh of electricity generation produces over 1500 pounds of Carbon Dioxide Equivalent (CO2E), or just over ¾ of a ton. Using that as our starting point, we should look at the assumed societal cost of carbon (SCC) pollution to determine a potential high-end range for the value of a REC used to offset that pollution.

Renewable Energy and Carbon, a Clear Relationship

The SCC is a contentious and hotly debated value representing the economic cost of climate change, the implied cost of increased pollution on health care, and several other factors. Studies from a few years ago estimated a value of ~$10/ton, while other models and research have implied an SCC as high as $200/ton. The most recent guidance from the US Government supports an SCC of roughly $50/ton, so we will use that number as the upper end of our estimate.

Since a single MWh of renewable generation offsets approximately 0.78 tons of CO2E, one would need to generate 1.28 MWh of renewable generation to eliminate one full ton of CO2E. That infers that the implied carbon value of each REC is between $14 and $64/MWh.

Reducing Consumption – The “Nega-Watt” Influence

The upper band of REC values faces significant resistance around $20/ton. Even more so beyond $30/ton as alternative ways of reducing carbon footprint becomes more competitive around this price range.

Specifically, companies may opt to make investments to reduce electricity consumption, sometimes referred to as negative watt load or “nega-watt,” when RECs reach this price range because the “nega-watt” option becomes more economically viable.

Most ESG plans call for significant reductions in overall consumption of energy as the first line of attack. Ways to reduce consumption include energy efficiency upgrades to lighting and insulation, window glazing, and even incentivized behavioral changes. These become significantly more financially attractive as the cost of either the energy itself or the REC to reverse its carbon output becomes considerably higher.

According to a 2020 report by Columbia University, the implied benefit of lighting and HVAC upgrades exceeds $60/ton, and insulation upgrades are also well over $40/ton of implied benefit. They indicate a carbon abate cost equivalent of approximately $30/ton, with education programs likely to drive that number to under $20/ton.

The Bottom Line

With decreasing available supply of RECs for voluntary buyers, the market is almost certain to continue to increase in value.

If the cost of construction and generation are the only factors affecting price, then one can assume a slow progression of required REC values as optimal sites are developed, and lower potential sites are looked to. This should drive prices up towards the levels seen in European wind development with a range from $6-$16/MWh.

If one assumes that carbon footprint reduction is the real goal and that the marginal cost solutions to carbon footprint reductions will be sought by corporate buyers, voluntary REC prices should quickly approach, but not exceed, that $20/ton or $25/MWh target price before the end of the decade.

GM announcement of a 180 MW solar deal in September 2020 (https://plants.gm.com/media/us/en/gm/home.detail.html/content/Pages/news/us/en/2020/sep/0930-sustainability.html)

PepsiCo Jan 2021 650 MW wind purchase (https://renewablesnow.com/news/pepsico-inks-partial-off-take-for-665-mw-of-us-wind-by-rsted-727935/)

Columbia University study (https://www.energypolicy.columbia.edu/research/report/levelized-cost-carbon-abatement-improved-cost-assessment-methodology-net-zero-emissions-world)