July 31, 2024

What’s Happening?

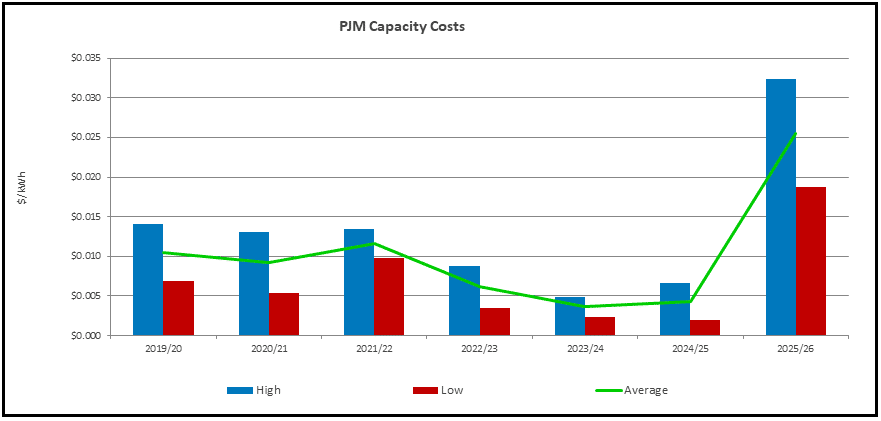

The PJM Capacity auction conducted earlier this month cleared at the highest values ever, amounting to a total capacity market cost of over $15B, a nearly 10-fold increase.

The auction, covering June 2025 to May 2026, has been influenced by new rules. These rules, particularly those governing the treatment of most renewable resources and generators with state-level subsidies, have significantly shaped the auction’s outcomes.

What’s the Impact?

Most of PJM will see capacity costs, one of the line items that is part of retail electricity supply, jump from a small fraction of a cent today to nearly 2 cents per kWh starting next summer. Customers with lower load factors, a symptom of erratic power usage, will see even more dramatic increases.

Customers within Maryland’s Baltimore Gas and Electric (BGE) service area will see the highest costs as the planned closure of coal power plants early next year creates a constrained area without adequate local resources. Typical customers there could see costs skyrocket from roughly half a cent per kWh today to well over 3 cents starting next June.

What’s Next?

Virtually all resources offered in the auction process cleared, which is highly atypical for the PJM system but could result from the extraordinarily high clearing price. Because the auction covers a future period, customers will not see an immediate impact on their retail costs but should budget for significantly higher costs starting next year.

Even customers on fixed price agreements may see increases as some contract clauses allow for the pass-through of extreme changes such as this. Contact your Tradition Energy Advisor for more information.