An Act to Advance Clean Energy

On July 31st, the Massachusetts House overwhelmingly approved Bill 4857, An Act to Advance Clean Energy, with the Governor likely to sign the bill, making some alterations and additions to the current Renewable Portfolio Standards.

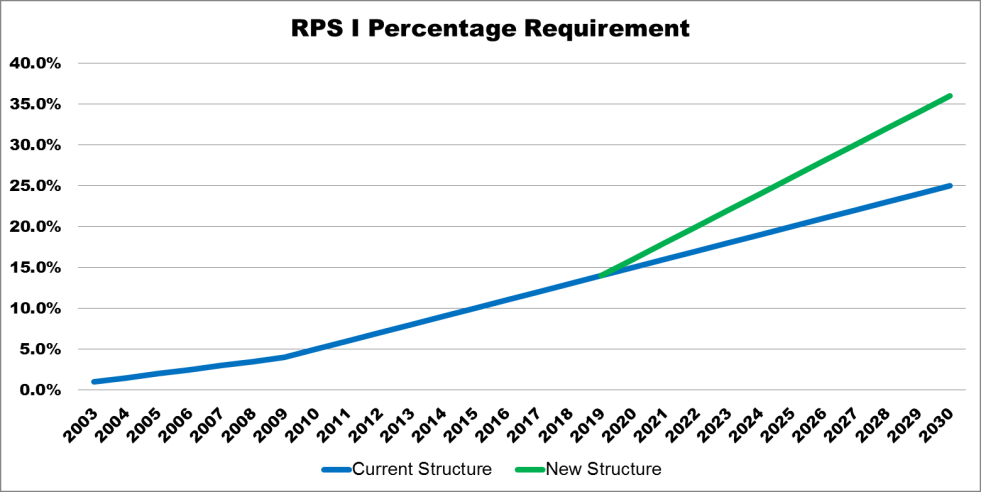

For over a decade, Massachusetts lawmakers have been creating and adding to laws that require all suppliers of electricity (including utilities) to procure a certain percentage of the electricity they sell from certified renewable generators. The original legislation called the Renewable Portfolio Standard, started in 2003 with all suppliers required to purchase 1% of generation from qualifying renewables. The requirements have since increased annually and have been divided into various categories including two RPS Classes and the Alternative Portfolio Standard (APS). A solar specific subset of the RPS Class I obligation in the form of the Solar Carve-Out program was added in 2010. Prior to this most recent amendment, suppliers were required to obtain 13% of generation from RPS Class I renewables, 3.6% from RPS Class II renewables, 3.5% from RPS Class II waste energy generation, and 4.25% from APS.

The revised rules passed under H4857 includes an increase of the RPS requirement growth rate from 1% per year to 2% per year. The annual increases would start in 2020 and run for 9 years, which would push the overall RPS requirement over 35% by 2030.

The bill also contains a new type of compliance resource called the “clean peak” resource. This category would act as a peak dispatchable subgroup of renewable resources such as batteries and demand response. Neither the percentage requirement nor the financial structure of the new sub-class has been set but both will be established by the end of the year with an annual growth rate of 0.25% per year.

One key element of the bill that it contains a grandfather exemption for any supply agreement signed before December 31, 2018 to be exempt from the additional annual RPS increase. This means that there is still time to enter into new supply agreements to protect from the additional costs sure to result from these added requirements.