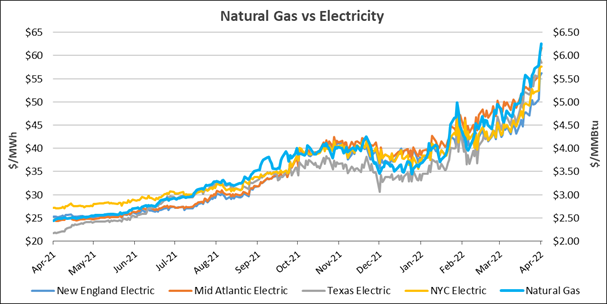

April 7, 2022 – Over the past few weeks, significant price increases in the natural gas market have driven electricity prices higher as natural gas is the largest cost component contributing to the price of electricity in most US electricity markets.

Natural gas prices are higher overall due to the fundamentals of limited supply vs. abnormally low gas storage levels and the resulting risk of failing to replenish our gas reserves before next winter. The low storage levels increase market sensitivity to weather, which has led to extreme price volatility following frequent weather forecast revisions. Adding to the volatility is reduced market liquidity, which causes more erratic and more prominent price movements.

Market fundamentals do not support the erratic movements in natural gas prices, which directly impact electricity prices across the country as natural gas is now a dominant fuel source for electricity generation.

The graph below compares natural gas and electricity futures market prices for May 2022, where a clear correlation is seen.

With Summer weather outlooks calling for warmer than normal temperatures across most of the country, along with the late cold weather experienced in the Northeast, Tradition anticipates persistent market volatility in the coming months and prices to remain elevated for the remainder of 2022 and into 2023.