June 15, 2022 – Revised information on the timeline for repairs to the Freeport LNG export terminal pushed the US natural gas markets lower on June 14, and expectations of increased injections into storage in the coming weeks eased fears of shortages for the coming winter.

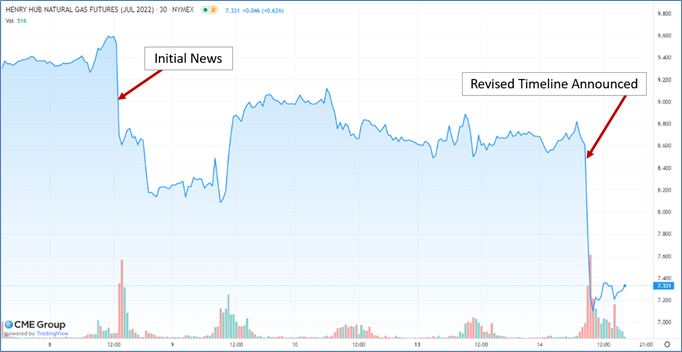

As previously reported by Tradition Energy, the Freeport LNG terminal was damaged on June 8 due to an unexplained rupture of piping near the storage tanks. Initial statements from plant operators indicated the facility might return to service as quickly as three weeks but still resulted in prices pulling back more than $1/Dth as news broke.

Revised statements early on June 14 indicated a partial return to service in mid-September with a full return to service later in the year. Those estimates were in line with projections published by Tradition Energy on June 13, but as the market learned of the extended outage, natural gas markets dropped again, this time by more than $1.50/Dth, before recovering slightly and closing down $1.42, the largest single-day loss in over 20 years.

LNG export demand has been a key driver of higher domestic natural gas prices as roughly 20% of US production is exported, primarily via LNG liquefaction facilities. Freeport is the second largest of the liquefaction terminals representing nearly 20% of US LNG capacity and consuming over 2 billion cubic feet (Bcf) of gas daily.

With Freeport’s gas consumption now set at zero for several months, roughly 200 Bcf of additional injections into storage are anticipated over the next few months, cutting our deficit, bringing storage levels closer to normal, and helping ease prices back through 2023.

Although typically closely tied to natural gas prices, power prices have not followed the initial drop in natural gas markets but are anticipated to show at least some softening in the coming week with varying impacts. The strongest pullback in electricity markets should be in the mid-Atlantic regions, with Texas expected to see more modest declines. On the other hand, New England may see prices rise if the outage continues into early winter because it relies on LNG to meet winter gas demand.