February 21, 2024 – What is happening?

Starting about a decade ago, the U.S., including Texas, began moving toward a greener electric generation environment promoted by government policy, including financial incentives for building renewable generation. The consequence was that coal plants were shuttered, and there was no investment in dispatchable generation, with all the investment going into renewable generation. This lack of conventional generation makes the ERCOT system increasingly reliant on renewable generation, which is inherently difficult to predict and control.

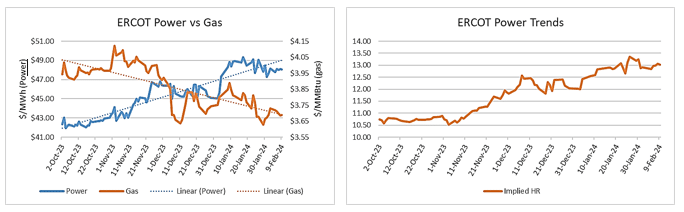

The result is that electricity prices have become much less correlated to natural gas prices and more to weather events such as wind patterns, cloud cover, and temperature. Additionally, the effective installed generation in ERCOT has not kept up with growth, resulting in a very tight supply and demand balance.

What is the impact?

Due to the tighter supply and demand balance and the unpredictable availability of renewable generation, the ERCOT system saw a substantial increase in significant Real-Time price spikes. The frequency and magnitude of price spikes have increased risk to suppliers.

Risk costs money, which is passed onto consumers through higher prices. Furthermore, with the increasing volatility in real-time markets, we have seen forward markets rise due to the growing risk of unpredictable prices in all seasons. The impacts became increasingly evident starting last year. Looking at just the previous five months, you can see long-term power prices rose 15% while natural gas fell 10%, causing the implied Heat Rate to increase by more than 20%:

What happens next?

If the coming spring or summer continues to bring frequent price spikes as wind and solar generation fluctuate and fail to meet power demand, the implied heat rate will increase further, driving forward power prices even higher.