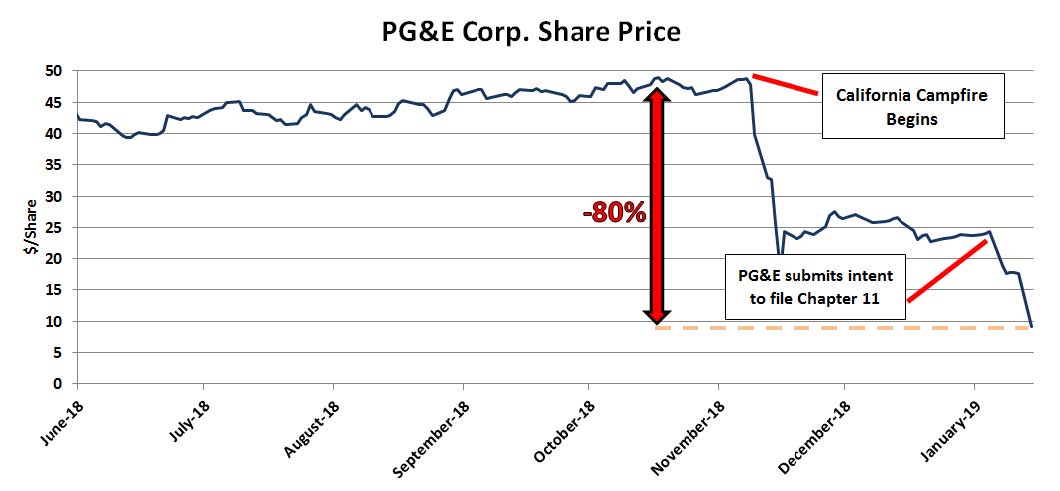

January 14, 2019: Pacific Gas and Electric, California’s largest investor-owned utility, filed an official 15-day notice that it intends to file petitions to reorganize under Chapter 11 of the U.S. Bankruptcy Code on or about January 29th. A bankruptcy filing by PG&E will have a limited impact on our customers as the utility will likely continue to operate as normal. In effect, the lights will stay on and natural gas will continue to be delivered to customers as the company keeps its essential services in place during the bankruptcy proceeding. In its notice the utility has also assured regulators and the public that they remain committed to continued investments in system safety. From a broader energy market perspective, PG&E’s active role as a hedger in the western wholesale energy markets could impact liquidity in the regional electricity and natural gas markets should the credit difficulties make continued transactions impossible. However, the impact of wholesale market liquidity on the overall price is likely to be of a very limited nature.

The bankruptcy filing is a result of the estimated $30 billion in potential liability costs due to wildfires in 2017 and 2018 that were allegedly started by PG&E’s equipment. The wildfires have led to doubts about the safety of the company’s electric distribution system, and investigators have already determined that PG&E’s equipment is liable in at least 17 major wildfires back in 2017. In addition, an investigation is underway to determine whether the company will also be liable for the November 2018 Campfire that killed 86 people and destroyed 14,000 homes.