May 5, 2023 – If you are a City of Lubbock LP&L customer, you have likely heard about the upcoming transition to the competitive energy markets. Below is a quick update on the transition, which has experienced a slight delay.

Lubbock Power & Light – Timeline to Deregulation

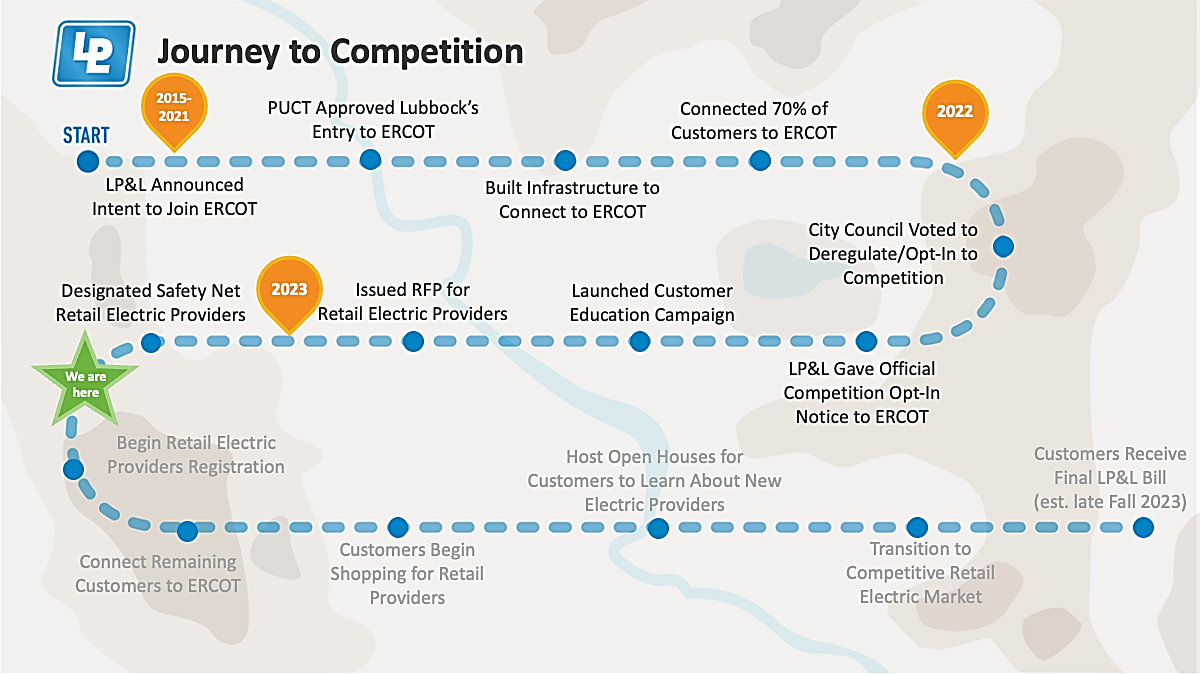

The pathway to deregulation started in 2015 when LP&L announced their initial plan to enter the ERCOT system and that deregulation would be part of the transition.

Below you can see Lubbock Power and Light’s deregulation roadmap, and several key milestones have already been reached. In May of 2021, LP&L successfully connected 70% of its system (approximately 83,000 customers) to the ERCOT grid, and then the city council confirmed the vote for deregulation in 2022. The green star on the graphic below indicates where we are with the transition as of today.

Source: LP&L

LP&L staff has done a lot of work, but a lot remains.

What is Energy Deregulation?

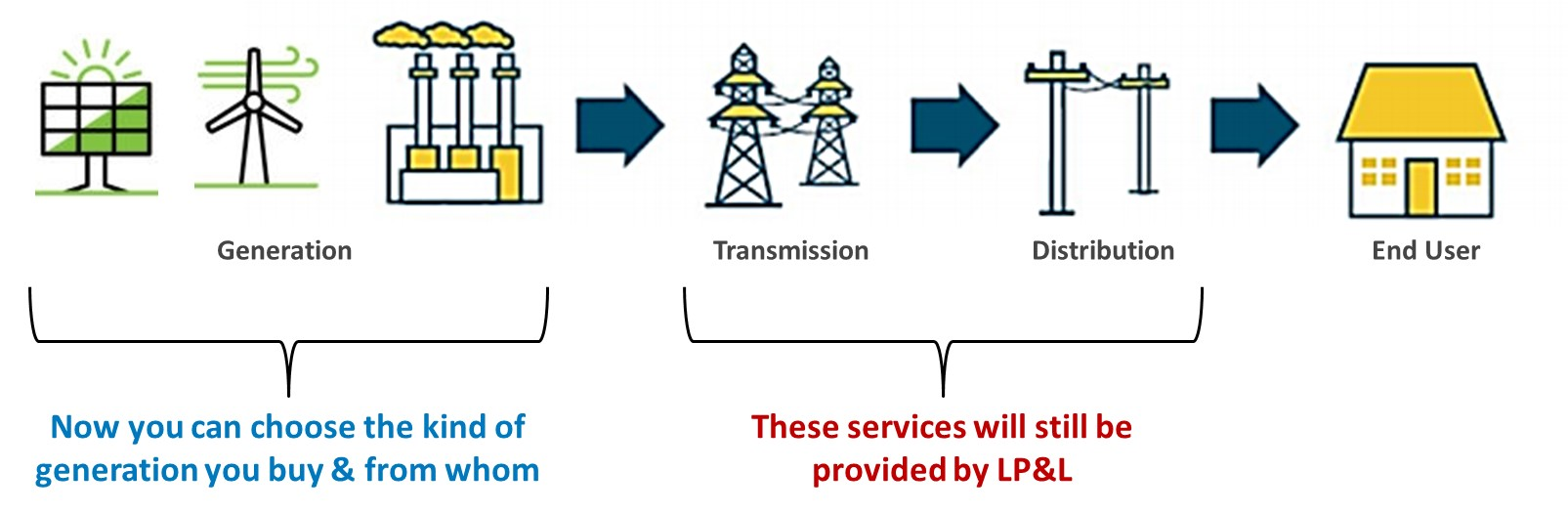

To refresh, let’s review what deregulation is. With energy deregulation, the delivery of electricity is separated from the electricity supply. The delivery of electricity will continue to be regulated, so Lubbock Power and Light will still be responsible for delivering the electricity across poles and wires and ensuring your lights stay on. The delivery infrastructure is LP&L’s to maintain. With deregulation, the electricity commodity is competitive. You now have the opportunity to choose your generation source and electricity supply from providers who compete for your business.

Electricity Deregulation Creates Competition Among Energy Suppliers

One of the decisions you can make is about what type of energy you purchase. Many product options will be available in the deregulated market, and determining which are best for your organization can be complicated.

You can evaluate the risks and benefits of the deregulated energy market options in multiple ways. You can buy green energy or conventional energy, and you can look for the lowest-cost solution. You can purchase a long-term contract for stability and go short-term if price volatility is high.

To summarize, deregulation separates the supply of electricity from the delivery of electricity, and Lubbock Power and Light will remain a delivery service.

LP&L’s Journey to Competition Has Been Delayed!

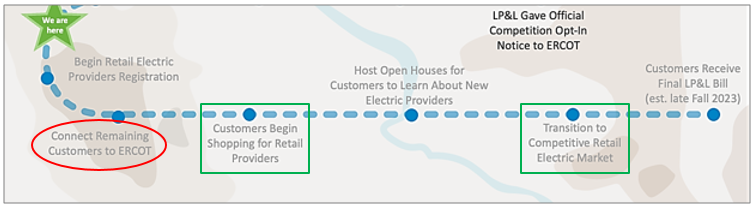

So, where are we now? The sequence of events must happen in a particular order, and we’re now going to focus on the remaining steps leading up to the start of energy deregulation. Lubbock Power and Light just announced a slight delay in the Federal Energy Regulatory Commission’s (FERC – the federal agency reviewing the switchover) approval of that last section of customers to connect to ERCOT and officially leave the Southwest Power Pool (SPP) system.

Because of that delay, it will cause other areas of the roadmap to shift in the timeline.

The report considers the timing of peak demands in Texas, which typically occur later in the afternoon or early evening, and how wind and solar resources may not be at the maximum output during those hours. It also accounts for other generators that burn fuel to generate power, and we call those “thermal” generators. These dispatchable units are occasionally down for maintenance.

Electricity consumption in Texas is on the rise, with peak demand reaching over 80,000 MWs last summer and expected to be even higher this year even if the weather is more moderate.

Some of the growth in demand is coming from the increased oil & gas drilling out west, but we also see a lot of load from crypto-mining being added to the region.

With weather outlooks calling for warmer-than-average temperatures this summer, the grid will likely face frequent tests. (see Tradition’s May 5, Market Monitor, ERCOT Summer Electricity Grid Outlook)

As of this writing, FERC has not established a new firm timeline for the switchover, so we cannot give exact timelines on how the schedule will change. But we believe that it will almost certainly be delayed. That does not mean this transition to competitive retail supply will not happen. It will just happen at a different time. It also does not mean that your beginning work on shopping for retail providers should not start sooner rather than later. It might give you more time to develop a plan.

The Next Six Months

In the next six months, we have some key milestones. Lubbock Power and Light is working to certify all electricity suppliers, and they are just starting the process. So if energy suppliers or brokers tell you they have a supplier for you now, that is likely inaccurate because Lubbock Power and Light has not licensed all suppliers. They are still going through the certification process, which will take some time as they complete all testing and verify supplier qualifications.

- May 2023

Why do you need a plan? Why should you move towards starting that shopping process now? As the qualified suppliers become registered in May, you can start looking at which ones best fit your organization. Some suppliers are going to specialize in specific industries, and others are going to specialize in residential. There will be different suppliers for different types and sizes of customers, and choosing the right one for you means evaluating all your options.

- Summer 2023

As we move into the summer of 2023, you want to start working on an energy supply procurement strategy to determine which products best meet your risk tolerance and operational needs.

Energy Expense as a Risk

The previously mentioned energy products, including long-term, short-term, variable, fixed, and various renewable attributes, all come down to one word, RISK. Why emphasize risk? Because energy expenses are a risk to your organization, managing risk comes down to a simple four-cycle program. You need to understand the different types of energy supply so you can manage the risk, address the risk, and have a sound procurement plan for the future.

A Cyclic Process

The priority is to Identify the risks to your organization. A typical risk is a price or cost, but there are many others.

Once you understand the various risks, you can Assess those risks, quantifying just how much exposure you have.

Next, you need to Evaluate ways to mitigate the risks. The fourth step is to Control and Monitor, which means keeping track of the market and determining if you should adjust your risk management strategy.

Risk Management is a cyclic process, and there may be new risks to identify and assess and new strategies to evaluate, and it is an ongoing process. This four-cycle process is how you can manage your risk from the energy markets in an efficient way, but it is all about being proactive, so as we look forward, we want to start working on a strategy now.

Electricity Procurement Best Practices

Even though LP&L may delay its move to deregulation by a month or more, you should still be working on a risk management and procurement strategy for your organization. Below is a list of electricity procurement best practices to follow.

- Get Organized

- Analyze When You Use Energy

- Understand and Follow The Wholesale Energy Market

- Develop a Strategy That Meets Your Needs

- Pre-qualify Energy Suppliers

- Conduct a Competitive Pricing Process

- Negotiate Agreement Terms, Then Reprice

- Verify Enrollment, Invoice Accuracy

- Never Stop Monitoring Markets, Reporting, & Adjusting

First, you want to get organized by gathering your invoices and usage history. The second is to analyze when you use your energy, not just how much, but when you are using it: days of the week, months of the year, hours of the day. You need to understand and follow the wholesale energy market because the wholesale market is where your “retail” electricity prices are established.

Next, you need to create a strategy that meets your needs, primarily based on the abovementioned risk management assessment. Once you have a strategy, it is time to pre-qualify energy suppliers, evaluating which ones have contract terms and structures that best fit your plan.

With that list of qualified suppliers, you can conduct a competitive pricing process to ensure that you have all the best bidders in the room to provide you with the best possible price. Upon receiving the initial bids, it is time to negotiate the terms of the agreement and conduct a final pricing round to ensure all offers are on equal footing to ensure that you are getting the best possible pricing options for your organization.

Once deregulation launches and your accounts begin receiving energy from your new supplier, you need to verify that they enrolled on time and that the invoices are accurate.

And the last step is critical. Never stop monitoring the markets, reporting, and adjusting your strategy. You must ensure that your strategy performs as planned and that you stay informed about the direction energy markets are moving. Staying informed will enable you to prepare for your next contract or budgetary change.

In summary, Lubbock Power & Light has announced a slight delay in its integration into the ERCOT market, which likely means a delay in the move to deregulation. It will still happen, so it is vital and timely to create a plan now.