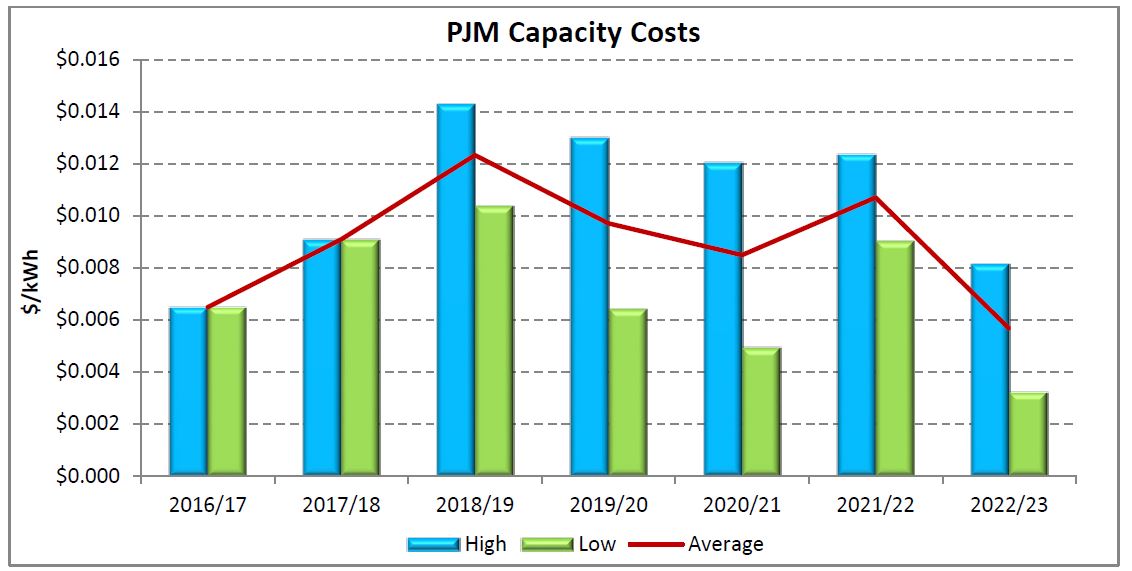

June 4, 2021 – PJM has completed the auction for Capacity resources for the June 2022 through May 2023 obligation period and the resulting prices were significantly lower than prior auctions.

Although Tradition had forecasted a slight reduction (~10-15%) in clearing prices in the PJM auction for 2022/23 obligation period, the actual results were nearly 50% lower across all regions.

The Rest of RTO category cleared at a mere $50/MW-day, 64% lower than prior auction’s $140, with demand centers in NJ and PA down ~50%. ComEd in Illinois and BGE in Maryland surprised in opposite directions with ComEd dropping to $69/MW-day, down 64%, against expectations that it remain over $100, while BGE cleared well above all other regions at $127, a decrease of only 22% from the prior auction.

There were a number of factors that appear to have contributed to the low clearing prices:

1. PJM lowered the forecasted peak demand by 1.6% from prior auction, meaning they were looking to purchase less capacity from generators.

2. The cost of new entry (CONE) calculations, which are used to set the starting prices of the auction, was reduced by an average of nearly 20%.

3. More Energy Efficiency (EE) projects cleared than in prior auctions (EE typically bids in lower than generation).

4. PJM wide Forced Outage Rate (eFORd) improved meaning existing generators now contribute more capacity than they did in prior auctions.

The results could impact several aspects of energy markets across PJM in the coming years:

1. Over 8,000 MW’s of coal generation failed to clear in the auction setting the stage for those generators to retire much sooner than expected adding to gas usage and price volatility in many regions.

2. The lower capacity prices will mean lower payments for Demand Response program participants and could reduce the likelihood of folks actually curtailing during summer peaks.

3. With the future of the Ohio nuclear fleet uncertain, the 60% reduction in the capacity payments they receive could lead to their retirement as the state subsidy has been cancelled.

4. Exelon Generation has already announced that because of the auction results it will retire the Byron and Dresden nuclear units in Fall 2021; although legislative action being considered in Illinois may reverse

that decision.

Tradition will continue to monitor the results for additional details which may impact the next auction which is scheduled for later this year.