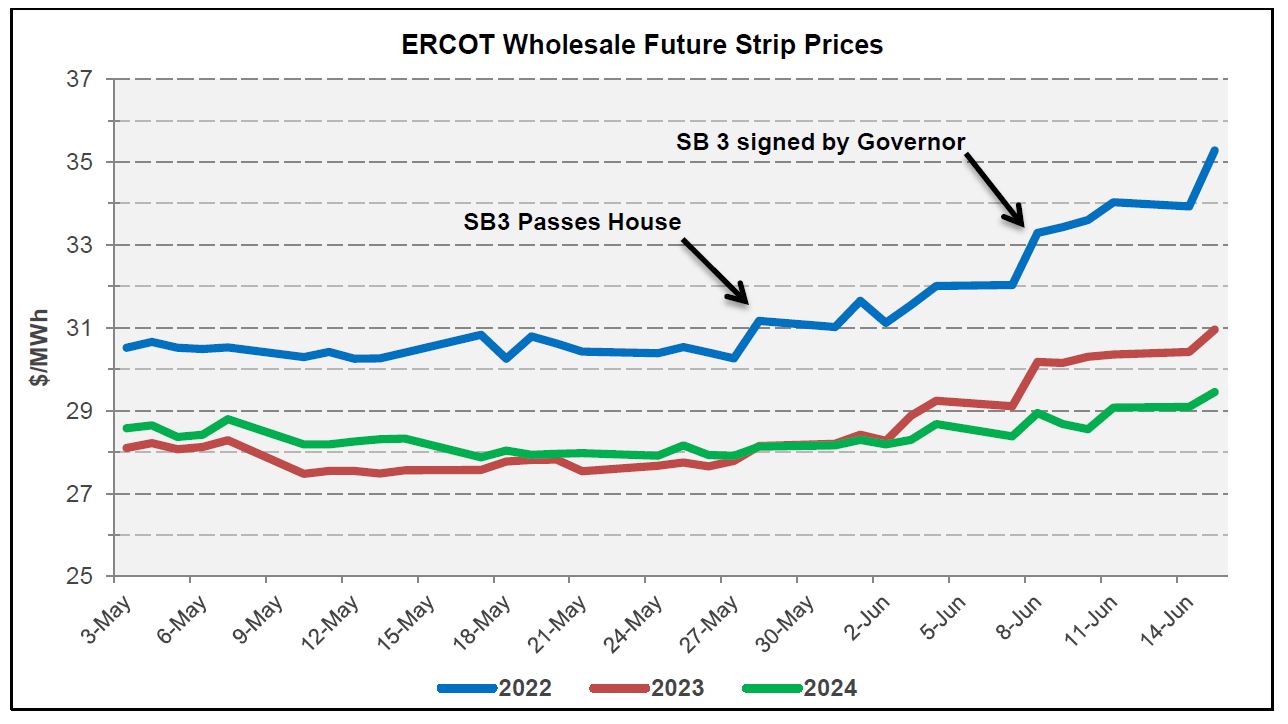

June 15, 2021 – In addition to high energy prices and demand due to persistent heat, several regulatory events are making it increasingly difficult to secure fixed price electricity supply offers in the ERCOT market, and in some cases suppliers are not able to offer any options at all.

Much of this trend can be linked to the passage of Senate Bill 3 (SB 3) in Texas which requires several changes to power plant operations but provides virtually no details on exactly what will need to be done or what it will cost.

The resulting uncertainty for power plant owners and operators has left many of them unable to offer hedges to retail suppliers, and those suppliers in turn are unable to offer fixed price products to consumers.

Texas SB 3 is a comprehensive bill covering many facets of energy and utility operations in Texas, but a key provision is the requirement for electricity utilities and power plants, as well as natural gas infrastructure operators to “winterize” their facilities.

The issue lies in the lack of clarity on what exactly will be required, or what it will cost.

Regulated utilities have the ability to collect for any cost of compliance through adjustments to delivery rates, but independent power plant owners, like in ERCOT, have no such guaranty so they need to ensure that any forward commitments to sell energy will reflect their costs to produce it.

With so much uncertainty regarding these new rules, something that may continue for many months or even longer, most generators are taking the cautious approach and simply not selling in the wholesale market.

Since suppliers rely almost exclusively on the wholesale electricity market to hedge their offerings, many are forced to retract supply offers or offer them for only limited periods of time.

Our wholesale brokers are actively engaging with existing market participants to help bring more sellers back but indications are that the current conditions will continue until there is more certainty about future electricity market rules.

Tradition Energy will continue to monitor the situation as it develops and provide updates as more information becomes available.