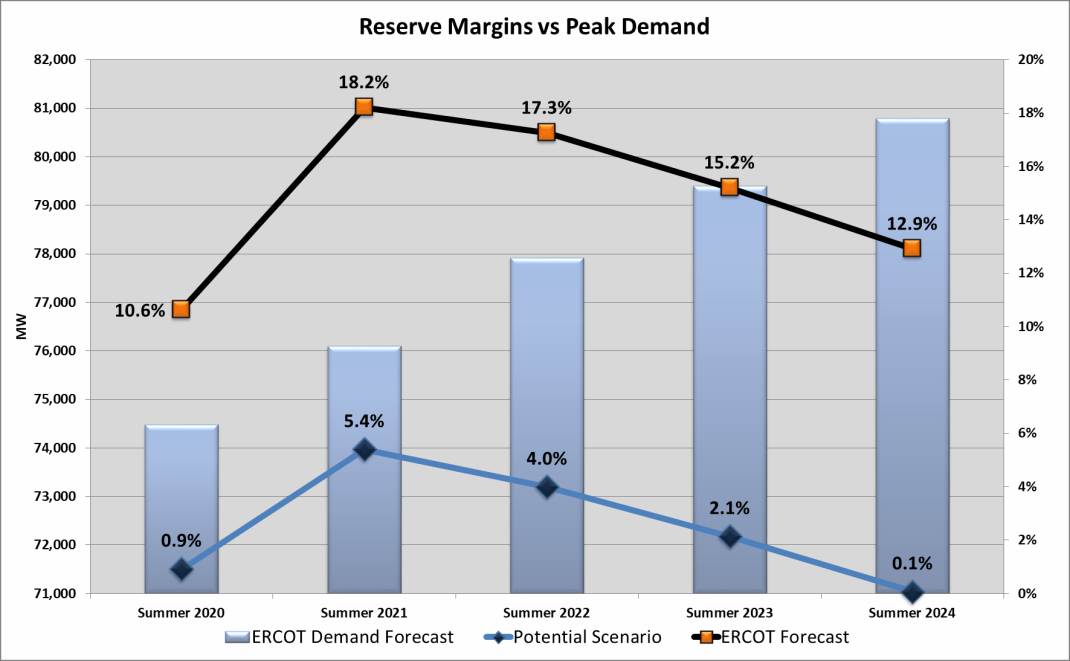

ERCOT’s reserve margins have been in focus for two years now and will continue to be as volatile renewables dominate the new build capacity pipeline. ERCOT projects reserve margins to be 10-18% over the next five years with the improvement between Summer 2020 and Summer 2021 primarily attributed to the near 5,000 MW of solar capacity and 700 MW of new wind capacity expected to come online. Assuming these projects enter service and perform at the capacity factors forecasted by ERCOT, demand should be met without too much trouble in the next few summers.

However, Tradition Energy has used scenario analysis to gauge the inherent risk of price spikes and has concluded that under more conservative measures of renewable generation contributions, actual reserve margins could be significantly lower.

Figure 1: Uncertain performance of renewable generation could significantly impact reserve margins in the next five years

ERCOT projects that during peak hours, utility-scale solar will contribute 76% of its capacity, while wind capacity across three different categorizations will contribute a weighted average of 39%. These contributions yield the above reserve margins (Orange) over the next five summers. Because new generation additions are largely renewables, even small adjustments to these capacity factors during peak hours will have a significant impact on the available supply. Tradition assessed that if solar and wind performed at just below 46% and 25% of their capacity, in line with what was witnessed during peak demand hours in summer 2019, reserve margins (Blue) would shrink well into single digits with the supply being nearly equal to demand in some years. This more conservative scenario highlights the risks that still remain in ERCOT; particularly after the un-forecasted drop off of wind last year that caused price spikes at or near $9,000/MWh, and the uncertain production of solar generation during early evening hours as peak demand trends later into the day.