Starting in late 2016, the regulators in Connecticut (CT-PURA) have been discussing the growing market for renewable or “green” energy products. As part of that investigation, conducted under Docket 16-12-29, it was decided that what qualifies as green energy and how it is marketed needed to change.

What did they find?

Regulators found that most green energy products being sold by energy suppliers were based on nationally sourced Renewable Energy Certificates (RECs) and not directly tied to energy generated within the state of Connecticut. Further, they determined that consumers did not properly understand the concept of RECs and assumed they were buying locally generated green energy when in fact the REC might be generated many hundreds of miles away.

Regulators feared that those RECs were not providing true environmental benefit to Connecticut through reduced local emissions or improved air quality. They also found that the marketing of such products decreased the potential spend on more locally beneficial products.

What is changing?

Beginning January 1, 2021 the marketing of current REC based products as green energy must be discontinued.

- REC based product offering must clearly be identified as non-energy products

- RECs must originate from New England, NY, or the neighboring electric control area known as PJM[1]

- RECs much originate from generators using technology which meets Connecticut RPS standards

- Existing contracts signed prior to the passage of the new rules using RECs from outside the region may continue until January 1, 2022 after which they must either be terminated or amended to meet the new rules

In addition to above, in order to be marketed as Green Energy a Voluntary Renewable Offering (VRO) must disclose the actual generator from which the REC is sourced PRIOR to the execution of the contract. This is sometimes referred to as an “asset specific” contract in current terms. Newly expanded disclosure labels for each product are required, as well as independent third party verification of certain aspects of the program. There are also significant prescriptive contract sections, terms, and clauses which will be required for both products.

How will this impact the voluntary renewable market?

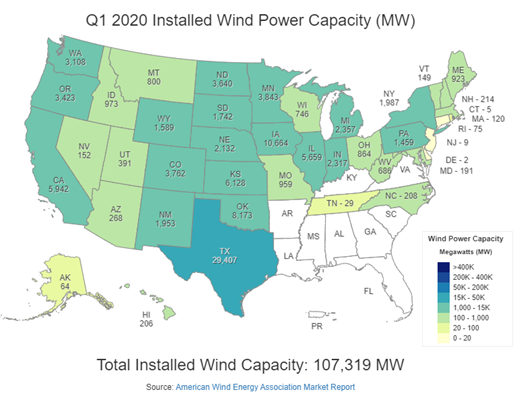

The new restrictions on what RECs can be offered within Connecticut from a geographic perspective exclude many of the largest wind resource markets including key areas of Texas, Iowa, Oklahoma, and Kansas. In fact, it excludes virtually all of the top 10 states[1] for wind generation in the US.

The inflexible nature of the new contract structures is also likely to impact how many suppliers are willing to participate within the marketplace.

Will it cost more to go green?

Increased reporting requirements and contract restrictions are hard to quantify but the decreased flexibility of sourcing alone is likely to increase the cost of going green in Connecticut from the current ~$0.0015/kWh by as much as 10 fold.

[1] PJM includes Delaware, District of Columbia, Kentucky, , Indiana, Michigan, Maryland, North Carolina, New Jersey, Ohio, Pennsylvania, Tennessee, West Virginia, Virginia and parts of Illinois

[2] Illinois was ranked #6 in 2018 and portions of it are within the PJM region