Many electricity markets follow natural gas markets as the majority of the generation is fueled by natural gas, and those gas generators set the price of power as often as 80% of the time. However, as energy markets evolve, this historically tight correlation has broken in some regions, namely ERCOT.

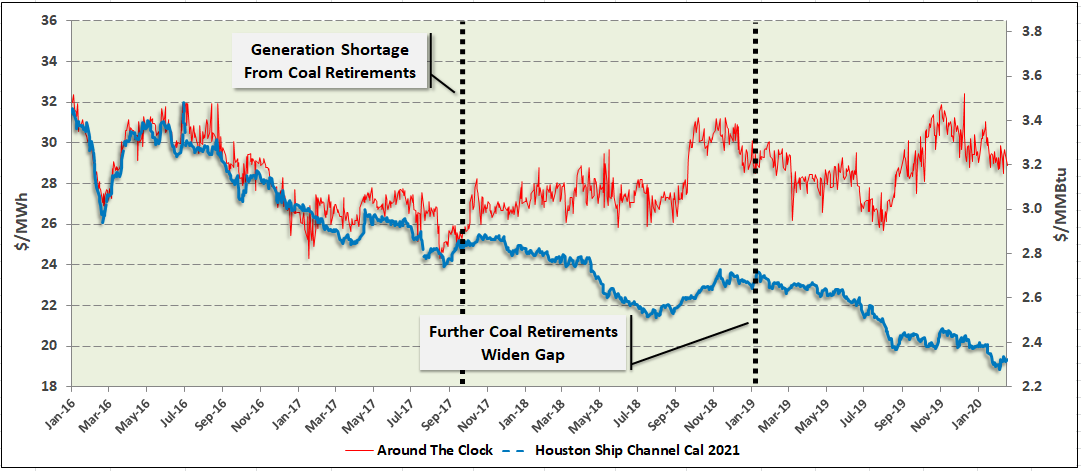

Before 2018, natural gas fueled ~40% of electricity generation while coal fueled ~29% throughout the year. Though natural gas generation still holds a ~40% share of total supply, coal’s share has dropped by 8% due to major retirements in early 2018. These retirements forced ERCOT’s reserve margin below the recommended 13.75% to ~8-10% for summer 2018 and 2019, causing forward electricity prices to surge. In fact, despite future (2021) natural gas prices declining significantly since late 2018, future electricity prices for the same period have continued to rise.

Figure 1: Calendar 2021 ERCOT North electricity prices demonstrating the decline in correlation with regional natural gas prices

The retirement of the predominantly inflexible coal plants stemmed partially from the buildout of renewables, particularly wind generation, as depressed off-peak periods, when the wind is strongest in Texas, challenged the economic viability of the plants. The integration of substantial wind capacity has been a significant driver of on and off-peak prices in ERCOT as the resource eventually seized five percent of coal’s market share in the generation stack. Off-peak prices have averaged just above $21/MWh as wind generation provides ample electricity supplies to the grid during those hours.

However, during peak hours and particularly during summer, when wind generation is lowest, prices are now exposed to spikes when wind generation is expected but does not show up. This risk was evident in summer 2019 when actual wind generation was 5,000 MW lower than expected, causing a price spike to $9,000/MWh. During that period, regional natural gas prices were once again flat, showing once again the disconnect between the two commodities as the market evolves.

Though natural gas still represents a significant input in ERCOT electricity prices, the connection between the two has been reduced as major retirement events, and the incursion of wind have become the main drivers of the market.